In addition to providing guidance on health insurance products, insurance brokers offer wellness advise and programming to their employer groups. Brokers are now being asked for advice on how to start wellness programs in the workplace. Whether they accept this role or not, brokers have been thrust into the added role of wellness consultant.

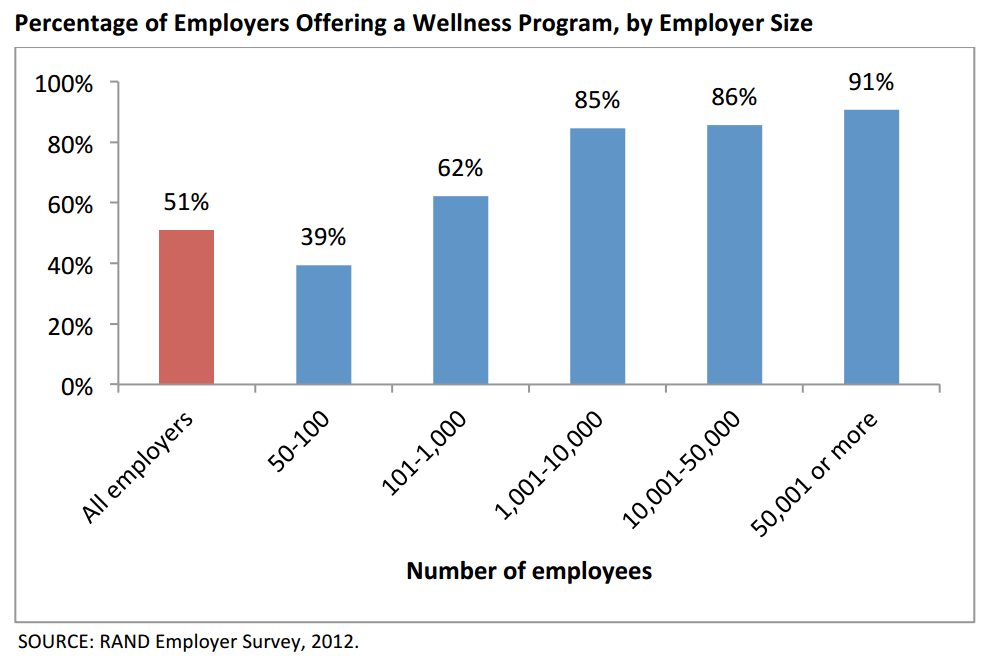

Health insurance brokers have been offering wellness to employers for decades. The most recent RAND Employer Survey reveals how roughly half of small and medium sized companies still do not offer any wellness services.

When insurance brokers offer wellness to their clients, they use a variety of approaches. When surveys asked what percentage of their book of business was doing a decent job of workplace wellness programming, the answer was always about the same: around 10%. That suggests that around 90% of small and mid-sized companies are doing little or nothing regarding workplace wellness.

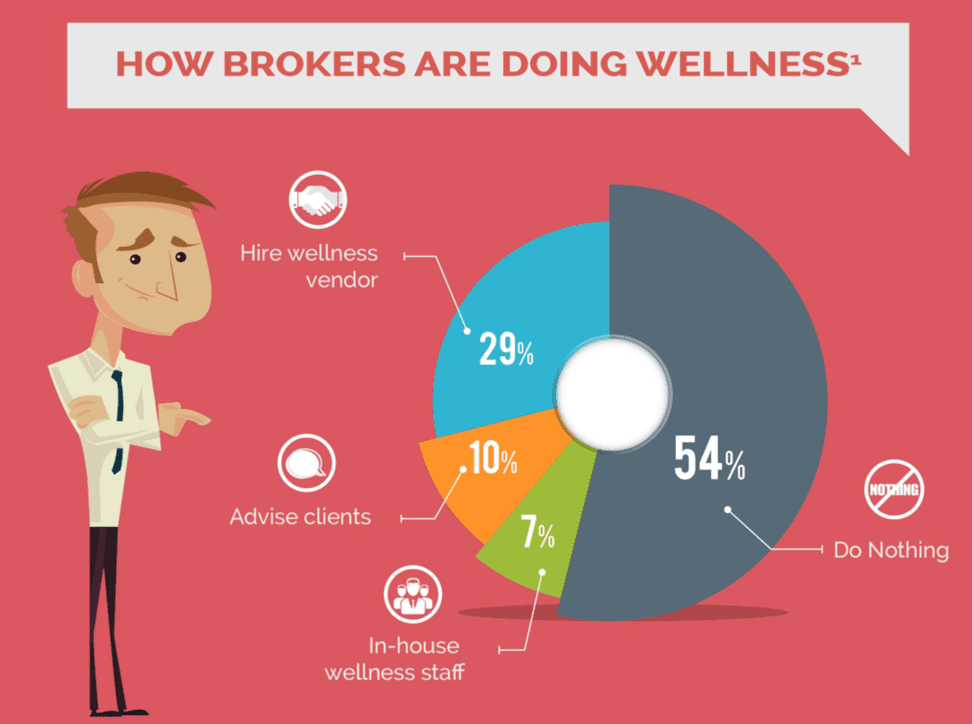

Several years ago WellSteps started surveying brokers to see what kind of advice and counseling they were offering employers. This survey data was combined with broker surveys conducted by the LinkedIn group: Wellness is a Business Strategy. Together, these data reveal four main ways health insurance brokers offer wellness to their clients. They offer wellness programs to stay competitive, grow their business, and add value and many companies are looking for a wellness program.

These surveys generated many different responses but we were able to cluster them into four main approaches. The purpose of this article is to carefully review the pros and cons of each approach and help brokers decide what is the best way to wellness to employers.

1.Many Insurance Brokers and Consultants Do Nothing

54% of brokers report doing nothing to encourage wellness to employers. Although this may seem like the easiest route, it does have its disadvantages. When employers ask about wellness, the brokers with no answers may lose business to brokers who have leveraged wellness to gain a competitive advantage. Here are examples of some of the responses from brokers in the Do Nothing group:

“I’m a broker, I sell insurance, I don’t do wellness.”

“I get paid to close deals, there is no money in wellness so why should I spend any time working on it?”

“I don’t have the expertise, time, or interest to advise my clients about workplace wellness programming.”

Below is a short list of the pros and cons of the Do Nothing approach. Even though this is the most popular approach brokers are taking to workplace wellness it does nothing to help employers solve their challenges with poor employee health and rampant healthcare costs.

| Pros | Cons |

|---|---|

| Maintains status quo | Most employers are not happy with the status quo |

| Requires no additional skills, expertise, time or resources | Employers are asking about wellness |

| It’s easy | Successful brokers use wellness to get a competitive advantage |

| You risk losing business |

2. Hire In-House Staff to Offer Wellness to Employers

About 7% of brokers reported that their firm had hired a wellness specialist to help provide wellness services to clients. Typically, a brokerage firm will have one individual who is tasked to help multiple accounts with their wellness efforts. This individual may schedule biometric screenings, arrange for flu shots, distribute a health risk appraisal or offer a fitness challenge.

In this arrangement, one individual is required to provide wellness support for a large number of clients. This allows the firm to market its wellness services against firms that do not provide such services. Hiring an internal wellness professional is a great way to provide limited wellness services to a large number of clients.

The downside is that none of these programs are comprehensive. Instead, they are sporadic, one-time wellness events that are not part of any comprehensive, long-term strategy. They make for great marketing benefits, but lack the substance needed to really produce meaningful wellness outcomes. They are akin to having a workplace safety program that consists of a once-a-year discussion about safety.

The In-House Wellness approach may help some people gain health awareness, but there is no published scientific evidence that it can reduce elevated health risks, improve health behaviors, or lower employee-related expenses. That doesn’t necessarily mean that this approach can’t produce any results; it simply means that there is no peer-reviewed evidence to show that it does.

If employers are interested in starting a workplace wellness program as a strategy to improve employee health and reduce employee-related expenses, then this approach will likely lead to disappointment.

To Summarize

| Pros | Cons |

|---|---|

| It’s exclusive, encourages loyalty | Fail to deploy and engage enough people to make a difference |

| Can be packaged with benefits | No evidence that this approach works |

| Wellness can be a revenue stream | Marketing hype and clients know this |

| Great for marketing | Self serving, not client serving |

3. Insurance Brokers Offer Wellness by Advising Clients on How to Start a Wellness Program

Brokers who start advising clients on matters of workplace wellness programs stop working as brokers and start acting as consultants. The problem here is that brokers get paid with commissions while consultants get paid by the hour.

So, in order to take on a consultant role, brokers have to start providing services and assistance for which they do not get paid. Some may fear that this will lead to “service creep” as clients start requiring more and more assistance without additional pay.

Brokers who advise clients about wellness become trusted advisors. About 10% of brokers take this approach and thereby are able to build relationships, strengthen current contracts, and differentiate themselves from others. On the other hand, this approach may require some wellness training. This training can come from additional schooling, certifications and personal study.

We used to offer webinars. Since, our dissemination strategy has improved. At the time, our list of webinar registrants were mostly consultants and brokers working to boost their understanding of wellness programming. Kudos to them for working to become more knowledgeable and effective advisers. If you can make the transition from commission-based broker to trusted adviser, you stand a better chance of maintaining and cultivating new business.

| Pros | Cons |

|---|---|

| Build a relationship of trust | You’ll be expected to do more (service creep) |

| Strengthen current contracts | You’ll need to become a wellness expert |

| Differentiate yourself by adding value to what you do | Someone has to do the work of wellness |

| Gain more business | Talk is cheap, clients need help doing wellness |

4. Hire a Workplace Wellness Vendor to Offer Wellness to Employers

| Pros | Cons |

|---|---|

| Shifts responsibility to the employer and vendor | Wellness is outsourced. Brokers have less control. |

| Gets away from exclusivity, focus is on helping the employer (trust) | Employers will be required to get serious about wellness. |

| Gives clients the best wellness possible | Requires greater support from senior leadership |

| Best chance of keeping clients happy and loyal |

So What?

The list of pros and cons shown above will help you understand which approach is the best option for you to take, but there is another way to look at this decision. Pretend you are the CEO of a company and you are looking for a good broker and a successful wellness strategy. What would you like to see in this relationship?

- A wellness program that stays with your company regardless of which insurance company or broker you work with

- A wellness program that is effective at improving employee health and reducing employee-related expenses

- A wellness program that is backed by a performance guarantee

- A broker who will help you solve your problems, not maintain the status quo or push you into solutions that only generate more broker income

- A broker who understands your challenges and is truly interested in helping you out, even if there is some service creep

- A win, win, win relationship that will last for at least 10 years

Below is an infographic that summarizes each of these options. Pass it along.

[maxbutton id=”1″]