Proof Wellness Programs in the Workplace Make You Money

Workplace wellness programs appear to have a massive financial benefit that has just been discovered. Publicly traded companies that have award-winning wellness programs out-perform the stock market by a huge margin.

Three recent studies demonstrate that publicly traded companies with best-in-class workplace wellness programs have better stock valuations than the S&P’s stock index. A portfolio comprised of award-winning companies would be a dramatically better investment. Before I get into the details, here is a little perspective…

Companies With Wellness Programs in the Workplace Perform Better

There are thousands of mutual funds all of which invest in several companies that balance risk while seeking to maximize return for investors. Another way to invest is to purchase individual stocks in each of the 500 largest companies. These 500 companies make up the Standard and Poor’s 500 Index.

Rather than hunting for bigger returns by investing in companies that look promising, this investment strategy buys stock in all 500 companies. This strategy is called index investing. Over a one, five, and ten year period very few mutual funds perform better than the S&P.

Over a 15-year period, the index has an average return of about 11% per year. Not too bad. If, during that same time period, you had invested in companies who won the Koop Award for offering an outstanding workplace wellness program, you would have earned over 26% per year. In essence, your money would have doubled every 3 years.

If during a 15-year period you had invested in companies who won the Koop Award for offering an outstanding workplace wellness program, you would have earned over 26% per year.

RELATED: How to Choose the Best Workplace Health Promotion Programs

Companies With Outstanding Wellness Programs in the Workplace

Each year the board of directors of the Health Project review wellness applications for the C. Everett Koop National Health Awards. To win the award employers must describe their workplace wellness program in great detail. The job of the reviewers is to identify the award winners based on a rigorous evaluation of each program based on participation rates, and the improvements in employee health and medical cost savings.

So in this study, the investigators tried to answer the hypothetical question: what would happen if you bought stock in the Koop Award winners during the month they won the award? Over a 14 year period, there have been 26 publicly-traded companies who won the Koop Award. If you want the exact details of the study methodology, you can read the paper here.

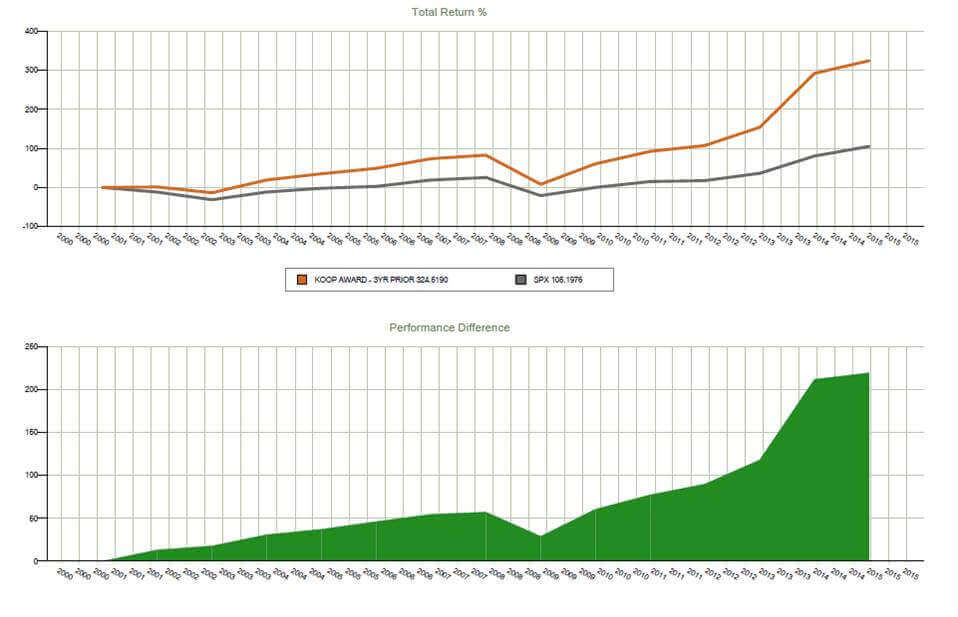

Mostly importantly, here are the results below. The orange line shows the total percent return on investment for Koop Award winners from the time the award was made. The grey line is the total return of the S&P 500. The second graph shows the cumulative advantage of the hypothetical Koop Award portfolio.

What These Results Mean

It is true that these results can trigger a fair amount of skepticism. Any investment with growth of 26% annually must either be a Ponzi scheme or a once-in-a-lifetime investment opportunity.

Time for the warning: the scientific truth of the matter is that this study proves absolutely nothing. It is not a randomized clinical trial. It is a retrospective study that, at best, can only suggest an association between companies with workplace wellness programs and their stock performance.

But it does raise a provocative question: was this just luck or is there really something about successful companies that just happen to have good wellness programs? Certainly there are other publicly traded companies that also perform well but don’t have wellness programs. Right?

If this were the only study with these results, you probably could have dismissed the findings as an academic exercise in retrospective stock picking. But in the same January 2016 issue of the journal JOEM, there was even more supporting evidence.

RELATED: Employee Wellness Programs: How They Save Money

More Reasons to Begin a Wellness Program

Each year the American College of Occupational and Environmental Medicine (ACOEM) gives out the Corporate Health Achievement Award (CHAA) to the healthiest and safest employers in North America. Applicants for the CHAA are judged on 17 standards in four general categories:

- leadership and management

- healthy workers

- healthy environments

- healthy organizations

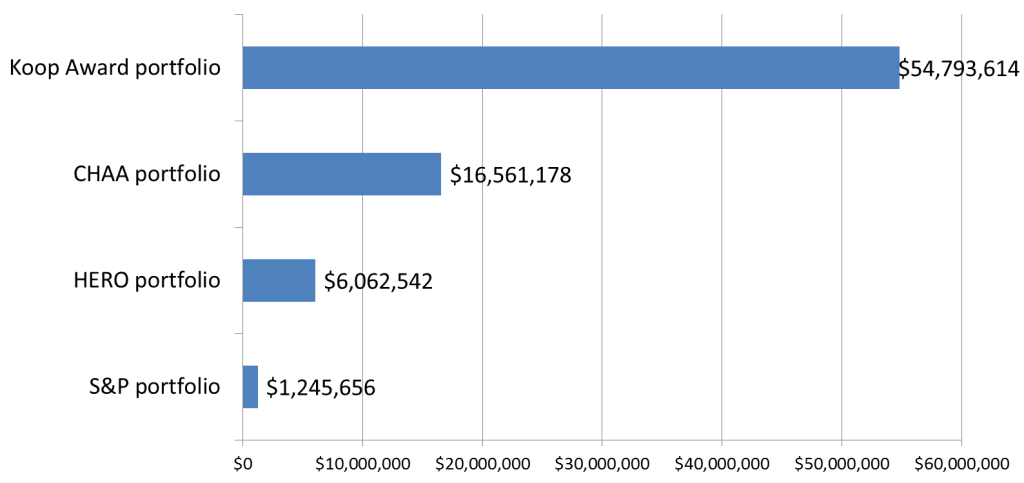

Employers submit applications that describe each of these areas and a panel of experts award points based on the information provided. Using a similar study design, employers from publicly-traded companies that had high CHAA scores were included in a hypothetical CHAA portfolio.

Stocks in each of these companies were “purchased” once high scores were determined. This mock portfolio was compared to a comparable S&P 500 portfolio. The CHAA portfolio had an annualized return of 13% more per year than the S&P.

In case you are wondering, a mutual fund portfolio or hedge fund that can consistently beat the S&P 500 by 13% per year is truly exceptional, about one in 10,000. Sound the skeptical alarms yes, but there are more results using an entirely different research methodology with different experts, criteria, and scoring. The combined results become harder to ignore, as you’ll see below.

A mutual fund portfolio or hedge fund that can consistently beat the S&P 500 by 13% per year is truly exceptional.

RELATED: 7 Reasons Workplace Health Promotion Programs Work (Here’s the Proof) 2023

It’s Time To Totally Freak Out

Another research study appears in the same journal. Once again, there were different authors, different methods, and a different research design. For years, the Health Enhancement Research Organization (HERO) has offered employers a chance to score the quality of their workplace wellness program by completing the HERO Scorecard.

The scorecard is an online tool developed to help employers improve their employee wellness programs with a self-evaluation over six core areas.

Scores from the 745 employers who completed the questionnaire from 2009 to 2012 were ranked from highest to lowest. Publicly-traded companies that had high scores were used to create another retrospective portfolio.

In 11 of the 14 years evaluated, these companies outperformed a similar portfolio comprised of the S&P 500 companies. The HERO portfolio had annualized returns that exceeded the S&P returns by an average of 15% per year.

Using the results from these studies, a comparison can be made in the hypothetical returns on each portfolio. Had you invested $500 every month in each of the portfolios described here, you can see how your money would have grown. The companies that have award winning wellness programs consistently outperformed the S&P 500 companies by a huge margin.

“Outperformed” might not even be strong enough. These portfolios smashed the S&P 500 portfolio. The annualized return of these hypothetical portfolios is greater then 99% of all actively managed mutual funds in existence today.

Said another way, if you had selected a portfolio of stocks from companies with exceptional wellness programs, you would have enjoyed a return on investment greater than nearly every hotshot stock picker on the planet.

RELATED: Employee Health Programs Worth Investing In

Can Wellness Programs in the Workplace Really Explain This?

Researchers who study the effects of workplace wellness programs commit their lives to producing scientific evidence about wellness programs. The wellness solutions we offer at WellSteps are based on this scientific evidence.

We have known for many years that workplace wellness programs can impact employee productivity, morale, recruitment, retention and other factors. But not in a million years would anyone have predicted that an excellent wellness program could actually result in corporate financial success.

Using multiple entirely different research methodologies, these combined results show that publicly traded companies with excellent wellness programs outperform the S&P 500 by a large margin. A good follow-up study would be to look at publicly traded companies that have lousy wellness programs and see how their stocks perform over time.

The presence of an excellent wellness program can act as a barometer of corporate success. Author of the HERO portfolio study, Jessica Gossmeier, put it this way:

"Maybe it is a proxy measure of great management. That is good enough, because great management is what makes companies perform and great management is what makes sophisticated investors invest."

Long time colleague Dr. Michael O’Donnell explains these results from a different perspective:

"Employers who are sufficiently capable and determined enough to develop excellent wellness programs, evaluate those programs, seriously reflect on the quality of their program, and/or apply for and win awards also understand how to manage their core business in such a way that revenues and profits will grow . . . which in turn causes the stock value to outperform the market."

So What Next With Wellness Programs in the Workplace?

All wellness professional and researchers are proud to be part of a profession that transforms people’s lives and helps create successful, sustainable organizations. High quality workplace wellness programs exist in organizations that care deeply about their employees, their products and services, and the success of their organization. Excellent stock performance is just one reason to start a wellness program.

If you don’t know where to start with getting a wellness program in place with your company, schedule a free demo with the Wellsteps team. Discover how not only your company’s stock performance improves, but also the wellbeing of your employees and teams. The results have a positive effect nearly everywhere.

Frequently Asked Questions

How successful are workplace wellness programs?

Working with an impactful and experienced wellness program provider or broker is essential in the success that you many see with a wellness program in your workplace. Utilizing an award winning program provider like WellSteps with a documented history of success with their clients will ensure the success of your workplace wellness program.

How to employee wellness programs benefit employers?

Not only will employees have many positive benefits from wellness programs such as better health outcomes, decreased stress, reduced health risks, increased mental wellbeing, the employers see many benefits as well. These benefits include lowered health care costs, increased productivity, retention, and morale, reduced absenteeism and presenteeism, and many more.

I am believer…if other organizations are to try and replicate these results, how do they define the statement below? “High quality workplace wellness programs”